How to Legally

Lower Your Taxes

Take yourself and your business offshore and reap the

benefits of legally reducing your taxes.

Imagine for a minute that you’re looking to buy a car

for $28,000.

You’re most likely going to read dozens of online

reviews, compare prices at various dealerships nearby,

and possibly time your purchase just right so you can

get the biggest discount.

All that trouble for a savings of maybe $4,000, if

you’re lucky.

Now, think about your tax bill. If your annual taxable

income is $500,000 and you live in a western country,

you’re easily paying $200,000 a year in taxes.

Why not look into lowering that expense?

Let me put that into perspective. In 20 years, you will

shell out $4 million in tax.

The truth of the matter is that the majority of people

put more effort into checking out the reviews of the

sushi restaurant they were thinking of going to on

Friday night than looking into how to reduce the tax

burden.

Imagine what sort of reviews the IRS would get… And I’m

not just talking about personal tax here. It’s exactly

the same for your business too.

People rack their brains to know how to grow their

businesses, attract more clients, reduce their spending,

and boost their profits. And yet, they somehow fail to

factor in their largest expense: taxes.

Perhaps you simply consider all those taxes as sunk

costs. And if you cannot see beyond the country walls

that currently confine your business, I guess that’s

true.

But the world has changed dramatically, and it’s time

your thinking changes as well. It’s time to think

globally.

Because your businesses can operate in the cloud where

borders do not exist, you can “go where you’re treated

best,” take yourself and your business offshore, and

reap the benefits of legally reducing your taxes.

Caribbean countries, amongst other countries, have

attractive Caribbean citizenship by investment programs

to compete over you.

You stand everything to gain, so here’s how it works.

How to Pay Less Taxes

CHOOSE YOUR BUSINESS TAX RATE

Moving your business abroad by setting up an

offshore company is not easy, but it certainly

can be done. Depending on your type of business,

you could potentially pay 0% tax.

CHOOSE YOUR PERSONAL TAX RATE

Move your ‘center of life’ abroad, and you could

potentially pay no tax at all. Explore some of

the best second residence countries first.

GET AN OFFSHORE TAX ADVISOR

You’ll need advice. International tax law isn’t

something you want to get wrong. You’d be

risking considerable fines or even jail time.

We’re here to help.

Countries Are Competing for Your Business

The greatest advantage governments have is that

they’ve brainwashed people to believe that there is

nothing better.

Nowhere is this more obvious than in the United

States.

People spend their entire lives thinking that the

USA is the best place on earth to live, educate

their children, go shopping, do business, and

invest.

They would never believe that they could get ahead

anywhere else.

But things have changed: location-independent

businesses are thriving with consulting empires

being built over the phone and Amazon FBA sellers

sourcing and selling products on a global scale.

You can basically make money anywhere in the world

if there is an internet connection.

So, let’s flip this thing on its head. Instead of

believing that one country has a monopoly on the

perfect lifestyle and business environment, realize

that there are countries out there competing for

your business.

Let that sink in.

Dozens of countries with no income tax across the

globe want successful people like you, and they’re

willing to offer liberal tax deductions, fewer

regulations, more efficient systems, and many other

benefits.

If you’re looking to lower your tax burden, you’ve

got options.

It’s time to shop around.

Countries – especially the ones that are looking for

immediate access to capital to sustain or accelerate

their growth –are seeking successful business

owners, investors, and high-net-worth individuals to

move to their country.

On the other hand, a US citizen will open a Health

Savings Account, track their medical expenses while

keeping each receipt to may or not be eligible for a

minor tax exemption of their adjusted gross income.

They will take a small slice of your profits, and we

do mean small, but largely, they have set up their

tax regimes to be beneficial to you.

US citizens don’t have to be stuck in the loop of

federal income taxes and The Earned Income Tax

Credit.

UK citizens can’t count on their tax code, which is

constantly changing.

It all comes down to one question: Do you trust your

country’s tax system?

Do you believe that your federal income tax bill is

going up? Can you count on a tax break?

Do you believe that investments in retirement

accounts are the best ones?

Sometimes it’s worth paying to get out of a bad

marriage. And sometimes it’s worth keeping.

Although, sometimes, it’s worth just making some

tweaks to it.

Nothing excites me more than helping businesses to

legally lower their tax bills by setting them up

with well-thought-out tax planning strategies so

they can go where they’re treated best.

My team and I can help you through the whole

process, from shopping around to find that ideal

place to creating your holistic strategy so that you

can legally reduce your personal and business taxes.

CHOOSE YOUR TAX RATE

If you’re reading this from a

high-tax-rate country, I’m sorry to say,

that you’ve chosen to pay that high tax

rate.

By choosing to stay put, you are sending

your own money down the drain and

straight into the pockets of the

taxman.

Your government has been successful because they’ve convinced you that you need to hand a considerable percentage of your income over to them on a regular basis.

You cannot go anywhere else. Your business will crumble without them. You owe it to them. The rest of the world is dangerous. You’re safer at home. It doesn’t get better than this.

That’s what they have you thinking.

Your government has been successful because they’ve convinced you that you need to hand a considerable percentage of your income over to them on a regular basis.

You cannot go anywhere else. Your business will crumble without them. You owe it to them. The rest of the world is dangerous. You’re safer at home. It doesn’t get better than this.

That’s what they have you thinking.

But that’s simply not true. You can

choose your tax rate. For some, this

will be 0% – living a tax-free life to

the fullest. Others will choose to pay a

low percentage as a trade-off for other

benefits.

For instance, you may forego paying 0% in Belize and choose instead to pay taxes in a country like Italy or Portugal through the Italy Golden visa or Portugal golden visa, where your total tax bill will be substantially lower than what you pay now.

For instance, you may forego paying 0% in Belize and choose instead to pay taxes in a country like Italy or Portugal through the Italy Golden visa or Portugal golden visa, where your total tax bill will be substantially lower than what you pay now.

You’ll lower your taxes but not

eliminate them, but you’ll be living in

Italy instead of Belize. Do you see the

trade-off? There are plenty of

jurisdictions offering either one of

these options – zero or low tax. We’ve

served more than 1,000 high-net-worth

individuals to optimize their personal

and corporate tax rates. Yes, it’s more

complicated than you think, but that’s

where we step in. Our team sits down

with government officials and pinpoint

loopholes that we can leverage. We care

more about getting the job done right

than signing off a client and moving on

to the other. That’s how we work. We get

clients that ended up paying double

their tax bill because they went to a

country that blacklists the country

they’ve chosen to set up their offshore

country. There are endless scenarios

that can go wrong, but you don’t need to

learn this firsthand. We’ll be happy to

serve you. That being said, there are

many countries that offer generous tax

exemptions and other similar incentives

to motivate people to move there. By

deciding to go where you’re treated

best, you can choose your tax rate and

take control of your life. It’s up to

you.

OFFSHORE TAX AVOIDANCE STRATEGIES THAT WILL NOT

LOWER YOUR TAXES

Now, there is an important difference between

choosing your tax rate and skirting the taxman.

One is legal; the other is not.

So, before we discuss the techniques you can

employ to lower your tax burden, let me dispel

two pervasive myths about lowering your tax

rate.

First, there are many people who believe that

they can pull off the exact same strategies used

by Google, Starbucks, and Amazon to lower their

taxes.

But your business is probably not a

multinational company with a hundred thousand

employees and offices spread all over the world.

That’s just not your reality.

Your business neither needs nor can it execute

such a highly complex tax plan.

Google’s tax plan will not work for you. You

need something specific to your business and

your personal situation.

The way you do things must be, as they say in

Southeast Asia, “Same same but different.”

Don’t copy someone else’s plan because it works

for them. That could land you in hot water.

Instead, make a plan based on the same

principles that are tailored to you. Think

things through and then create solid systems

with the help of professionals.

Second, many think that if they open an offshore

bank account, they’re automatically exempt from

paying taxes on the money in that account.

And, once again, that couldn’t be further from

the truth.

An offshore bank account will certainly protect

your money, hold foreign currency, and even

garner higher interest rates.

But it won’t lower your taxes.

Just because the money is overseas doesn’t mean

it won’t be taxed at home.

Ultimately, the jurisdiction where the money is

earned is what matters. And if you’re a US

citizen, all that matters is that the money

belongs to you.

An offshore bank account won’t lower your taxes.

So, let’s look at what will…

Personal and Business Taxes: How to Pay

Fewer Taxes

I’m the goody-two-shoes of the offshore

industry. I’ve earned that reputation

because I insist on doing things

legally. Anything less than 100% legal

is unacceptable.

The same should be true for you. If you

want real freedom – not just lower taxes

– then you need to do things properly

without cutting corners.

But when you don’t know what you’re

doing, it can be easy to slip up here

and cut a corner there without even

knowing until you’re slapped with an

exorbitant fine or even faced with jail

time.

Creating an international tax strategy

is complicated.

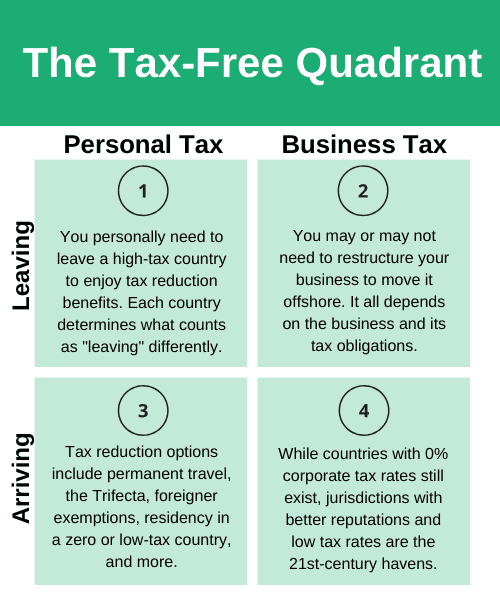

That is why I have created the tax-free

quadrant to simplify the bigger picture

and illustrate the different elements

you must address to ensure that you can

legally lower your taxes.

3. YOUR PERSONAL TAX IN THE PLACE YOU’RE

ARRIVING

We’re getting to the exciting bit – choosing a

new country (or countries) to live in. There are

two ways you can go about selecting a new

jurisdiction for personal tax reasons:

CHOOSE A ZERO OR LOW TAX COUNTRY AND OBTAIN TAX

RESIDENCY

When it comes to choosing a no or low-tax country,

don’t feel trapped into thinking that you must move

to one of the countries with no income tax, like the

United Arab Emirates or Seychelles – two of the many

traditional offshore havens.

It’s true that you should choose a country that has

smaller taxes, but don’t cloud your thinking by

settling for a 0% tax rate only.

Sure, there are jurisdictions such as the British

Virgin Islands, the Cayman Islands, the UAE, or the

Seychelles where you could pay no tax, but these

aren’t very desirable places to live.

Why not make a trade: and pay a low percentage of

the tax for a better quality of life? As I mentioned

before, there are quite a few benefits to paying a

little tax.

For one, you’ll be able to tell the tax authorities

where your home base is so that no other

jurisdiction tries to get you to pay their tax.

Atypical Partner Limited clients commonly move to a

territorial tax country such as Thailand, Costa

Rica, Georgia, or Singapore, among others.

You can live there for as long as you want and if

your income is foreign-sourced, you won’t have to

pay local tax at all.

And don’t forget about countries that offer all

sorts of simplified tax regimes, flat tax rates, or

foreigner exemptions. For example, Italy will take

you in if you pay them 100,000 euros in tax. That’s

all they require.

Depending on your income, that could be a great

deal. Say you make 10 million dollars a year, which

would make Italy’s tax bill less than 1%. It’s

worthwhile checking for other such tax arrangements.

LIVE THE LIFE OF A PERPETUAL TRAVELER

Your other option to reduce your taxes in quadrant

three is to live the life of a perpetual traveler if

that appeals to you.

As a perpetual traveler, you would go to multiple

places every year and only spend a limited time in

each location so as not to trigger tax residency

requirements.

You can travel as much as you like, but if you’re

like me and benefit from having a base, consider my

Trifecta Method.

From a lifestyle point of view, I personally like

Montenegro in the summer, London in the Fall, and

Malaysia in between.

You could pick and choose your own countries or just

go traveling around the world while working and

making money at the same time.

Just know that if you spend six months or more in

any single country, they will likely try to tax you.

OBTAINING TAX RESIDENCY STATUS

For both scenarios, it’s very important to obtain

the status of tax resident in a tax-friendly

country.

Even if you’re a perpetual traveler or you’re

leaving your home country, the tax authorities will

want to know exactly where your new tax home is

located.

If you’re able to spend 90 days in one place, rent a

place, get a driver’s license, obtain a residence

permit there, and more, it will be helpful to

solidify your tax residence case.

Establish new connections and shut down old ones

when you move from your home country to a new

jurisdiction. Make it look like it’s your home.

You won’t need to live there full-time, but you’ll

need to ensure that the time you spend in your

original ‘home’ doesn’t exceed the time in your new

one.

For example, if you’re spending four months in your

home country and two weeks at a time in 16 other

countries per year, your tax residency case isn’t

that strong.

4. YOUR BUSINESS TAX IN THE PLACE YOU’RE

ARRIVING

You’d think that moving your business to a zero

or low-tax jurisdiction would be

straightforward. But, of course, countries like

the ‘fun’ of making things quite complicated.

For example, you can’t move to Portugal to take

advantage of their non-habitual tax residence

(i.e., zero personal tax rate) and have an

offshore company there. They simply don’t allow

offshore companies to be registered under your

name.

And then there are the curveballs, such as the

US being a legitimate offshore haven for some

people and certainly not for others.

Wherever you choose, make sure that you move

your company to a low-tax country and spend as

little time in your home country as possible.

You don’t want to give the tax authorities a

reason to think you might be a ‘double agent’.

Move overseas, hire employees, or open offices

to have an easier time reducing your taxes.

And just a quick word on tax havens – they are

dead as we know them. Belize might be a 0% tax

country, but it’s not reputable nor desirable to

live there. Neither is Seychelles.

You must think about 21st-century tax havens,

the ones of the modern era. For example, Malta

could qualify with its 5% tax because it gives

you so many options as to where you can bank,

visit and live – the entire EU.

YOUR PERSONAL TAX IN THE PLACE YOU’RE

LEAVING

Have you always dreamed of moving your

business to the British Virgin Islands –

a long-standing offshore tax haven –and

saving on tax while you continue to live

in the US? Not going to happen. That’s

not how offshore business works. If

you’re personally a tax resident in a

high-tax country (e.g., the US,

Australia, Canada, the UK, or New

Zealand), then your corporation will

also be a tax resident there. It won’t

matter if you’ve incorporated offshore.

In fact, all that an offshore company

will give you is more paperwork. If

you’re a US citizen, your company will

be considered a Controlled Foreign

Corporation, and since you are

personally based in the US, your company

will have a permanent establishment

there and will qualify as being engaged

in a US trade or business.

All of these provisions, among others,

will result in a mountain of reporting

requirements for your offshore company…

that will ultimately be taxed in the US

anyway with very few tax savings, if

any. You personally need to leave a

high-tax country to enjoy tax reduction

benefits. There are countries that do

not have these provisions. Most western

countries do, but there are countries

that are more lenient and want your

business, and so they will not subject

you to such strict provisions. But if

you’re in the US, the UK, Australia, or

Canada, you cannot set your company up

offshore and then live at home. You need

to leave. That doesn’t mean you can’t go

back to visit. It doesn’t mean you need

to renounce. And if you decide that you

don’t like living abroad, you can always

go back and pay taxes again.

But it’s not that difficult these days

to find new locations you’d be happy to

call home. There are plenty of

incredible places to live and run a

business around the world. You must be

sure, however, that you have

successfully exited the tax system of

your home country. If you think that

this merely means living in your home

country for 182 days or less per year,

then think again. It’s far more

sophisticated than that. If you’re

looking to leave a country, spending

less than half a year, there is not

enough to count as ‘leaving.’ Recently,

countries have started to consider an

individual’s center of life, where they

derive their economic subsistence, and

where their center of vital interest is

located, among other factors.

That’s why you need a solid plan if

people come asking questions. In most

cases, you’ll need to dissolve all ties

with your previous country:

- Close bank accounts

- Sell your car

- Sell or rent out your home

- Change your mailing address to another country

The fewer ties you have to the country

of your previous tax residency, the

better. If you get the right

professional help, personally leaving a

jurisdiction should be a straightforward

affair. US citizens, however, should

keep in mind that they will remain

liable to file annual tax returns

wherever they are in the world.

US CITIZENS AND THE FEIE ADVANTAGE

If you’re a US citizen, there is no escaping the

fact that you’ll always be a US taxpayer unless you

choose to renounce your US citizenship. To go with

that option, you should get another citizenship by

investment to avoid being stateless.

The renunciation matter gets complicated if you

still want to be spending some time in the United

States and enjoy the advantages that US citizenship

provides. But if you’re a US citizen who is a tax

resident abroad, you get to enjoy a sizable tax

exemption.

Sure, the $105,000+ exemption might not seem big in

the grand scheme of things if you’re a six- or

seven-figure entrepreneur, but every little bit

helps. That’s already a start on your tax reduction

strategy. All you need to do to qualify for the

Foreign Earned Income Exclusion (FEIE) is spend 330

days in a given tax year in a foreign country or

country.

Based on the FEIE rules, you won’t be asked where

your new tax residence is located. All you need to

prove is that the US is no longer your home.

It doesn’t necessarily mean that you will pay no

tax, especially if you’re making more than the

threshold, but it does mean that your tax bill will

be reduced dramatically for the first $100k.

2. YOUR BUSINESS TAX IN THE PLACE YOU’RE

LEAVING

Whereas moving your personal tax

presence is relatively simple, moving a

business entity is more complicated.

However, it all depends on whether

you’re a tax resident in the

jurisdiction where your business is

located. For example, if you’re not a

tax resident in the US and have an LLC

there, you can just up and move your

business to a new jurisdiction – you

won’t have US tax obligations anymore.

If you are a US tax resident and have an

LLC that you wish to move abroad, you’ll

need to contribute it to a new

jurisdiction. Things also depend on the

nature of your business. Is it a one-man

show? Can the owner quit and move assets

to a foreign country? Then just do that.

Or is it an actual business with daily

operations taking place? You’ll need to

talk to a tax advisor to move such a

business because you might be liable to

pay tax,t and you definitely want to

minimize that.

In such a scenario, the ideal way to

transfer your business to a new

jurisdiction would be to sell the

business to yourself. And what if you

own some intellectual property, say a

patent worth $100,000? You could also do

a tax-free reorganization to a foreign

country (ideally, one with low or no

tax), but western countries such as

Australia and Canada will try and make

you sell it and pay tax over the sale.

Moving your business abroad does not

always mean that you have to undo your

entire business structure. Sometimes

that is the case. Sometimes it’s not.

Whatever your situation, let’s talk.

THE BENEFITS OF ECONOMIC CITIZENSHIP

INSTANT PASSPORT

You can obtain a second passport via investment

in as little as 3-4 months.

ENABLES RENUNCIATION

US citizens can use their CBI passports to

renounce their citizenship and save on tax.

TRAVEL PRIVILEGES

Visa-free access to the UK, Ireland, Hong Kong,

Singapore, the EU, Central America, South

America, and Southeast Asia.

NO NONSENSE

A streamlined process for individuals in good

health with a clean background.

LOW RISK

No need to travel to or live in the country.

Your citizenship is guaranteed.

HARD-TO-ACCESS COUNTRIES?

Different CBI passports grant access to Russia,

China, South Africa, and even the US.

It’s Time You How to Pay Less Taxes

We’ve covered a lot of tax reduction strategies in this

article, so let’s regroup and summarize. It is clear

that the world has changed. There are now many more

opportunities to make money from almost anywhere in the

world.

Physical location doesn’t matter as much as it used to

anymore, which threatens the traditional work setup that

countries have relied on to fill their coffers by way of

tax.

Because of this, many countries are willing to go to

extraordinary lengths to compete for your business,

offering tax incentives to move your business to their

jurisdiction.

From tax deductions to flat tax rates or even lump sum

tax, there are ways to not just pay fewer taxes but even

avoid personal and business taxes altogether.

You’re not bound to pay the adjusted gross income you’re

paying Some countries offer a tax credit, some cuts and

more for simply bringing your business to their

countries. has no capital gains tax, tax deductions,

including generous cuts,

Meanwhile, the US, Australia, the UK, and other western

countries are continuing to suck their people dry by

charging exorbitant personal and business tax rates.

They have enough power and enough sway over their

populations that they can just keep taxing them and be

fine. Your country does not want to compete.

And while most people don’t bother to do anything about

it, you’re here because you’re asking questions.

I’ve given you loads of techniques and strategies to

think about in this article, but the most important bit

of advice I can give you is to think holistically.

Consider all four quadrants before you make any moves to

reduce your taxes.

You’ll likely need some advice, as international tax law

isn’t something you want to get wrong.

My team and I help high-net-worth individuals reduce

their tax bills every day.

Reach out. We’ll be happy to serve you.